What is salary packaging?

Salary packaging allows your employees to pay for certain living expenses from their gross salary. As those expenses are deducted first, tax is calculated on the remaining amount, lowering their taxable salary and the amount of PAYG they owe.

The things employees can sacrifice salary for are wide-ranging and can include:

-

- Electronic devices like phones, notebooks, laptops, and tablets

-

- Education and insurance

-

- Meals and entertainment

-

- One of the most popular choices – a novated lease for a new, used or existing car.

Why is salary packaging so important?

The cost of living is top of mind for most workers right now, especially with relentless rounds of interest rate rises and soaring inflation. As well, the tight labour market and the war for talent are giving more staff than ever before an opportunity to reassess job prospects and possibilities.

In this environment, employees increasingly look at factors besides base pay rates when on the hunt for the perfect position, which is why forward-thinking employers are offering flexible, tax-effective salary packages with a range of in-demand perks and benefits.

Salary packaging a car in Australia

Benefits for employees

Buying a car is a big deal for most people and comes with a hefty price tag. And that’s even before you consider running, insurance and service costs.

Salary sacrificing a car versus buying one outright has many advantages which are making novated leases and salary packaging an increasingly popular option for employees.

A Novated lease is essentially a three-way agreement between an employee, employer and finance provider to use the employee’s pre-tax salary to make payments for leasing and running a car.

For employees, the benefits of car salary packaging and novated leases include:

-

- Tax savings. Since the novated lease rentals are deducted from some of your employee’s pre-tax income, and since they are GST-free, they get both a PAYG and GST* tax break.

-

- Hassle-free expense management. All expenses are managed through regular pay deductions for the lease, fuel, insurance and service.

-

- A way to find the right car at a reasonable price. Your staff can lease either a new or used car to suit their budget, or even choose one of the latest generations of hybrid or electric vehicles (EVs).

Benefits for employers

Car salary sacrificing has huge advantages for employers too. It allows you to:

-

- Strengthen your Employer Value Proposition. Competition for good employees is fierce, and car salary packaging is a way to offer the same financial incentives as more sizeable businesses. More than 7 out of 10 employees* are interested in accessing salary packaging, yet with few having access, novated leasing could be a powerful tool to drive financial wellbeing and enhance your EVP.

-

- Boost your employees’ salaries, at no cost. Expenses for car salary packaging are deducted from participating employees’ salaries with no start-up costs or ongoing fees for your business. With the cost of living increasing and cars being one of Australia’s biggest household expenditures, car salary packaging gives you a meaningful and impactful way to support employees’ financial wellbeing.

-

- Minimise payroll tax. If your business qualifies for payroll tax, you could minimise your liability by reducing your employees’ taxable income through a novated lease arrangement.

-

- A strong retention hook. Car salary packaging and novated leases are strong retention tools.

Falling prices, improved technology, better infrastructure and favourable incentives are combining to create explosive growth for EV and plug-in hybrid (PHEV) adoption in Australia, and offering employees salary-packaged EVs will be a key way to boost your sustainability credentials and strengthen your EVP.

Flare makes car salary packaging easy

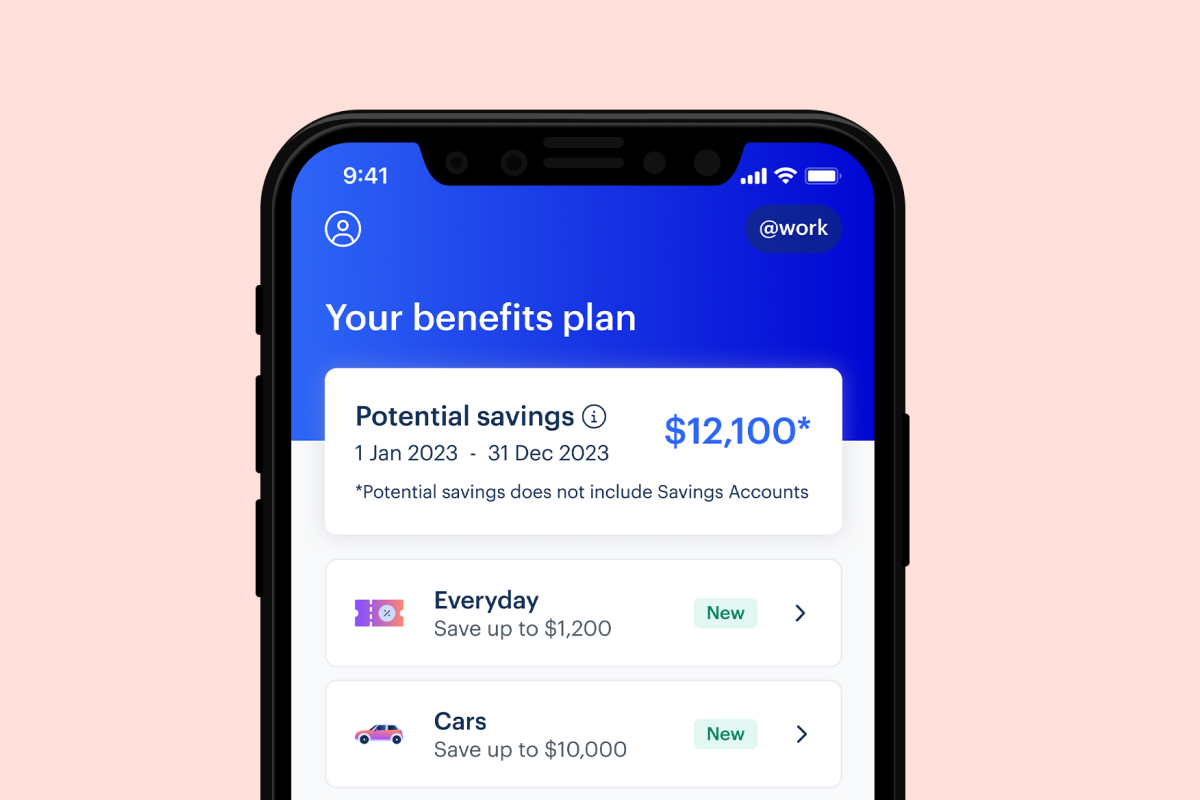

Offering your employees salary-packaged benefits like a novated lease for an EV can be game-changing. And with Flare, there’s no need to put it in the too-hard basket or go it alone with a DIY solution.

Flare’s experts are well-versed in all types of cars and we can tap into our dealership networks to make EVs and PHEVs more affordable for your employees.

Flare’s fully digital process streamlines the car salary packaging experience, making it faster, easier, and more convenient for both you and your employees.

With Flare’s car salary packaging, customers like healthcare company Healius and recruitment services provider Skout Solutions are experiencing the following impressive benefits:

- Healius employees have saved around a quarter of a million dollars since 2021 and the retention rate for staff with a Flare lease is tracking at 98 per cent.

- Almost 10 per cent of Skout Solution’s employees are using Flare novated leases and it’s saving them thousands of dollars in monthly repayments.

Learn more about how Flare can help you harness the benefits of salary packaging for your business.